AAK Group has released its interim report for the first quarter 2021, where the group announce continued earnings growth in a time of volatility and uncertainty.

AAK Group

- Total volumes for the quarter were on par with last year and amounted to 569,000 MT (569,000).

- Operating profit, including a negative currency translation impact of SEK 57 million, increased by 2%, reaching SEK 551 million (542).

- Profit for the period amounted to SEK 400 million (383), an increase by 4%.

- Earnings per share increased by 4%, to SEK 1.56 (1.50).

- Cash flow from operating activities amounted to SEK 58 million (71).

- Return on Capital Employed (ROCE), R12M, was 14.4% (14.3 at December 31, 2020).

Business areas

- Food Ingredients – operating profit decreased by 4% to SEK 313 million (325).

- Chocolate & Confectionery Fats – operating profit reached SEK 233 million (222), an increase by 5%.

- Technical Products & Feed – operating profit reached SEK 44 million (38), an increase by 16%.

CEO’s comments

The first quarter of the year has been characterised by a strong customer demand for our speciality and semi-speciality solutions, particularly within Chocolate & Confectionery Fats, Special Nutrition, and Plant-based Foods. This is very much a result of our teams around the world successfully executing on our strategy.

Despite the ongoing pandemic and a material negative currency translation impact, we achieved a higher operating profit compared to last year. At fixed foreign exchange rates, we increased our operating profit by 12%.

Business performance from AAK

Volumes for the Group were on par with last year with a sequential increase during the quarter. There was very strong volume growth for Chocolate & Confectionery Fats and for our high value-adding solutions within Food Ingredients. This was offset by lower volumes in Foodservice, which continues to be significantly impacted by Covid-19.

Operating profit amounted to SEK 551 million (542). This was driven by cost reduction measures combined with a higher share of speciality solutions. Operating profit per kilo reached SEK 0.97 (0.95). At fixed foreign exchange rates, operating profit per kilo increased by 13%.

The business dynamics within Food Ingredients were mixed with growth for our high-end speciality solutions within Special Nutrition and Plant-based Foods, and our semi-speciality solutions within Dairy. However, Foodservice, and to some extent Bakery, continued to be negatively impacted by restrictions and lockdowns.

Chocolate & Confectionery Fats reported strong volume growth, driven by our customer co-developed solutions. Demand in South Latin America and Russia picked up strongly during the quarter. The volume growth combined with implemented supply chain improvements resulted in a strong operating profit for the business area.

It was also a very good quarter for Technical Products & Feed, mainly driven by our feed business and high utilisation in our crushing operations.

Strategic investment

To further accelerate the development of ingredient solutions for alternatives to meat and dairy products, they have during the quarter partnered up with Big Idea Ventures (BIV). AAK’s investment in BIV’s New Protein Fund I will create new collaboration opportunities with some of the most recognised players in the food industry.

Continued strong sustainability progress

We continue to see strong development within the sustainability activities and the company’s contributions towards the UN Sustainable Development Goals.

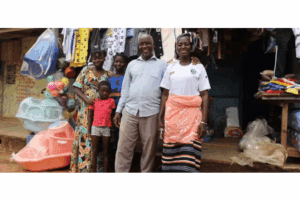

AAK have significantly increased the number of women involved in Kolo Nafaso, their direct shea sourcing program in West Africa. The program, which has a very positive impact on the women and their families, now involves more than 320,000 women. Another important achievement is that their verified deforestation-free palm increased by 92% during 2020 compared to the year before. This is an important step on the journey towards sustainable palm oil, where AAK aim for a supply chain that is 100% traceable to plantation and 100% verified deforestation-free by 2025.

They also continue their work to reduce their environmental impact and have recently decreased energy consumption, water consumption and waste per processed unit raw material. Furthermore, they have decided that ESG targets henceforth is included in the evaluation of the Executive Committee’s remuneration.

Uncertainty and volatility, due to the pandemic and current global logistics and sea freight disturbances, remain high. This makes it difficult to predict the short-term future. However, AAK has a robust foundation, a strong financial track record and a solid balance sheet, and they have over the past year demonstrated the resilience of their business. The passion, drive and agility their organisation shows are strengths they build on going forward.

AAK offer plant-based, healthy, high value-adding oils and fats solutions based on their customer co-development approach. They continuously strengthen their portfolio of solutions that are good for both people and planet. Despite the short- to mid-term uncertainty, AAK see no reason to adjust their view on the strong favorable underlying long-term trends in their markets. Thus, they continue to remain prudently optimistic about the future and they are fully committed to Making Better Happen.

Image credit: AAK Group

To stay up to date on the latest, trends, innovations, people news and company updates within the global confectionery market please register to receive our newsletter here

Media contact

Kiran Grewal

Editor, International Confectionery

Tel: +44 (0) 1622 823 922

Email: [email protected]