The snack market size in the US is expected to increase by USD 806.08 million between 2019 and 2024. The market observed a YOY growth of 2.05% in 2020 and the growth momentum is expected to accelerate at a CAGR of 2% during the forecast period. The report offers a detailed analysis of the recent developments in the market, new product launches by vendors, major revenue-generating segments, and market behavior across geographies.

Download a Free Sample Report Now to know more about the report coverage.

The market is driven by new product launches. In addition, the increasing demand for plant-based snack bars is anticipated to boost the growth of the snack bars market in the US.

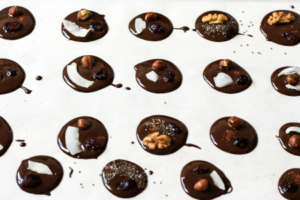

The convenience offered by snack bars have increased their popularity as meal replacement among consumers. This is encouraging vendors in the market to introduce a wide range of products. For instance, in May 2019, KIND launched its KIND Frozen bars in the US. The products are made of almonds, dark chocolate, and sea salt. Similarly, in January 2019, That’s it launched its new line of probiotic fruit bars containing 2 billion CFU of Bacillus coagulans GBI-30 6086 per serving. The products were introduced in mango, blueberry, and banana flavors. The increasing launch of such innovative products will be driving the growth of the market during the forecast period.

Major Snack Bars Vendors in the US:

Technavio identifies the following as the dominant players in the snack bars market in the US.

- Abbott Laboratories

- Clif Bar & Co.

- General Mills Inc.

- Kellogg Co.

- KIND LLC

- Mondelez International Inc.

- PepsiCo Inc.

- Quest Nutrition LLC

- The Hain Celestial Group Inc.

- The Hershey Co.

Snack Bars Market In US Product Outlook (Revenue, USD Million, 2019-2024)

- Energy and nutrition bars – size and forecast 2019-2024

- Granola bars – size and forecast 2019-2024

- Breakfast bars – size and forecast 2019-2024

- Other snack bars – size and forecast 2019-2024

The energy and nutrition bars segment generated maximum revenue in the market in 2021. The increasing consumption of energy bars as post workout snacks among people engaged in fitness activities is driving the growth of the segment. Also, the increasing number of gyms and fitness centers in the US is contributing to the growth of the segment. The market growth in the segment will be significant during the forecast period.

Read more of this article in our latest edition here: March 2022 Single Issue form – International Confectionery Magazine (in-confectionery.com)

Media contact

Roshini Bains,

Editor, International Confectionery

Tel: +44 (0) 1622 823 922

Email: editor@in-confectionery.com