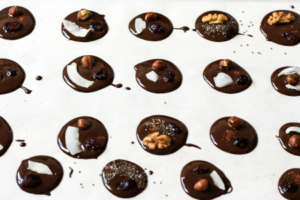

In a resounding testament to the resilience of the cocoa industry, futures for cocoa soared above £8,000 a metric ton in New York, marking a significant milestone amidst a backdrop of supply challenges and soaring prices.

Despite concerns over a global supply crunch and record-high prices, the pace of cocoa processing in chocolate factories has remarkably held steady. Data released on Thursday revealed that cocoa processing, known as ‘grinds,’ experienced only a marginal decline of about 2% in Europe, while showing a slight decrease in Asia during the first quarter compared to the previous year. Notably, processing in North America saw a modest uptick of nearly 4%. These figures come amidst a backdrop of futures prices more than doubling since the beginning of 2024.

Commenting on the industry’s resilience, John Goodwin, a senior commodity analyst at ArrowStream Inc., remarked, “The grindings numbers are nowhere near the deterioration we needed to end this rally. It’s crazy how resilient those numbers were.”

New York futures witnessed a remarkable surge, climbing as much as 11% to reach a record high of over £8,500 a metric ton, marking the most substantial intraday jump in over a month. Similarly, the most-active contract in London experienced a surge of nearly 11%.

Observers in the market are closely monitoring processing data to gauge whether the rally is beginning to impact demand and assess the challenges faced by chocolatiers in sourcing cocoa beans. However, the reliability of such data is increasingly in question as supply shortages make it more challenging to procure cocoa.

Paul Joules, an analyst at Rabobank in London, interpreted the grindings figures as “an indication that for now demand is holding up despite current pricing,” adding that “demand destruction will come, but clearly it’s taking longer to filter into grind data than the market was anticipating.”

Judy Ganes, president at J Ganes Consulting, highlighted that the slight drop in European grinds could be attributed to processors in the region compensating for closures in West African facilities, suggesting that global processing in the first quarter may have remained level or even decreased.

“The International Cocoa Organization estimated that global grindings will fall almost 5% this season, driven by a 7% drop in African processing,” Ganes explained. The severe shortage of cocoa and subsequent price surge have compelled some processors to intermittently halt production or pay premiums to secure supplies from minor growers.

Bloomberg Intelligence analysts Diana Gomes and Ignacio Canals Polo noted that the pace of grindings could “remain subdued into 2025,” as strong first-quarter data suggest that processors will need to replenish stockpiles of beans at higher prices. Additionally, consumer demand is expected to face continued pressure as recent cocoa price increases trickle down to retail shelves.

Read the full feature in our magazine.

Never miss a story… Follow us on:

![]() International Confectionery

International Confectionery

![]() @InConfectionery

@InConfectionery

![]() @InConfectionery

@InConfectionery

Media contact

Hannah Larvin

Editor, International Confectionery

Tel: +44 (0) 1622 823 920

Email: editor@in-confectionery.com